Layer 1 vs Layer 2: What You Need to Know About Different Blockchain Layer Solutions

Content

Bitcoin and Ethereum, the two main blockchains, are starting to face payment processing problems due to the growing number of users. The Bitcoin network can process 5-7 transactions per second, and Ethereum in its 1.0 iteration managed to process about 15 transactions per second. In order to span over the entire financial world, this is most definitely not enough. In comparison, Visa processes almost 25,000 transactions per second using the VisaNet electronic payment network.

This limitation of the transaction channel causes a number of problems. Networks are often congested and users are forced to basically enter auctions, offering ever higher bids in order to get their transaction processed first. As a result, at the peak of the NFT craze, the cost of gas fees per transaction sometimes exceeded $300. Imagine you would need to pay such a commission every time you buy something. Obviously, such a payment instrument is not well suited to the interests of users.

With Ethereum at its peak hosting about 1 million transactions per day, serious decisions are needed so that the ecosystem can continue to grow. There are such solutions in Layer 1, that is, within the blockchains themselves. And in Layer 2 — additional projects that are built on top of base blockchains to improve their scalability.

Layer 1 Scaling Solutions: Prospects and Challenges

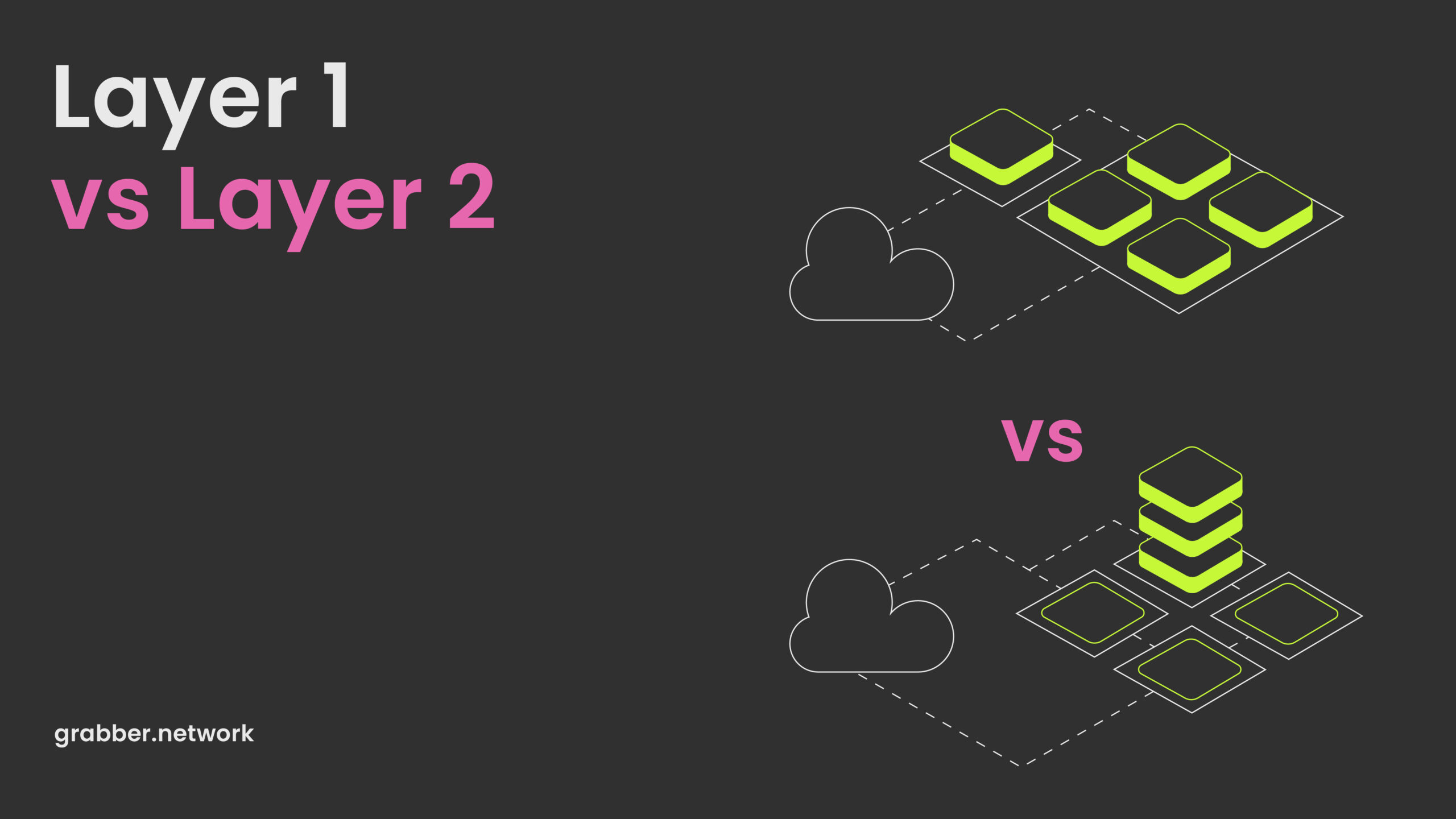

Layer 1 are self-sufficient blockchains like Bitcoin, Polkadot, BNB, Cardano and Ethereum whose infrastructure does not rely on any other network. These chains are able to verify transactions themselves and exist independently of the rest. To solve the scalability problem that grows as the adoption of crypto expands, all these networks are implementing their own solutions. Including sharding, transition to PoS and creation of additional protocols.

One of the first obvious solutions is to try to increase the block sizes so that even more transactions can fit into each block. This would make it possible, without increasing the overall number of blocks in the chain, to increase the number of processed TPS (transactions per second).

Unfortunately, the networks immediately ran into problems implementing this solution. One of the main ones is that validators needed even more powerful devices to process such blocks. Hence the inevitable decrease in the number of verifiers, and an increase in the centralization of the entire system.For example, in the spring of 2021, Elon Musk raised the idea that the Dogecoin network should increase the block size and the speed of creating new blocks by 10 times in order to reduce gas fees by 100 times and increase the scalability of the system. In response, Vitalik Buterin, one of the creators of Ethereum, argued that if standard users with a regular computer cannot run their validator nodes, this means that decentralization is not working. Which goes against the very idea of cryptocurrencies. In ten or twenty years, if you constantly follow this path, all the power will once again be concentrated in the hands of a few crypto exchanges and billionaires.

To prevent this from happening, modern Layer 1 networks are increasingly trying to solve the scalability trilemma through consensus and sharding mechanisms. For example, Ethereum is implementing sharding after moving from PoW to PoS in September 2022. This will divide the entire chain into 64 distinct shards, working semi-autonomously, which will allow the network as a whole to process transactions hundreds of times faster.

The solution seems much more elegant — and it already works in chains like Polkadot and Kusama to a certain degree of success. But even here there are some problems. Since each shard will be much smaller than the entire network in terms of the number of nodes, it will be easier for attackers to try to accumulate funds, gain power and capture consensus (51% of the votes) in some separate shard in order to exploit it for their operations. The shard system has yet to be tested in real and long-term operation, and even if everything turns out to be fine, this lurking threat will always remain.

Most people still look with distrust even at the largest cryptocurrencies. These fears need to be overcome gradually, so updates to Layer-1 are usually very conservative, especially for Bitcoin. At the same time, new solutions that are implemented in Layer-2 can be more radical and dynamic — if something does not work, only this secondary network will suffer the consequences.

How Do Layer 2 Scaling Solutions Work?

Layer 2 are projects or blockchains that are built on top of the base blockchain to improve their scalability. Bitcoin, for example, has a Lighting Network built on top of it. But most of these tools are created for Ethereum. There are such networks as Polygon, Arbitrum One, Optimism, Aztek and dozens of others. These solutions use smart contracts to automate transactions. Gas fees for operations when using these crypto projects are tens, sometimes hundreds of times lower than on the main network. You can look at the list of Layer 2 scaling solutions for Ethereum here.

Layer 2 solutions fall into several categories, each one having a different approach on how to make the network more scalable. These main solutions can be:

- Sidechains. Additional blockchains designed to reduce the load on the main chain. For example, the game Axie Infinity operates on its own chain, the Ronin Network, and communicates with Ethereum only in rare cases when a player is “cashing out”. This allows the game to remain flexible and get updates frequently, and allows its players to transact within Ronin virtually at no cost. Usually sidechains connect to the main chain through crosschain bridges. Other examples of sidechains for Ethereum include Skale (promoting zero gas fees), Gnosis Chain and Loom Network.

- Channels. These solutions make it possible to make some transactions off-chain. But at the same time, the participants in such an operation must be known in advance, and they must sign a multisignature contract. There are also various other limitations, and the network needs to be closely monitored. Examples of such scalability solutions include Raiden and Connext Network.

- Rollups. These solutions aim to execute transactions separately and send data about them to the main chain. There are two types of rollups. The first is ZK (zero knowledge), which combines a lot of transactions into one to then transfer this “roll” to the blockchain, making it possible to calculate up to 10 000 TPS. And the second one is optimistic rollups, which work in parallel with ETH and are very popular in dApps and DeFi. From the first type we can mention StarkWare and Loopring, from the second — Optimism.

- Plasma. One of the solutions proposed by Vitalik Buterin himself in one of his papers. Plasma uses a combination of smart contracts and crypto verification, as a result creating child chains to the main blockchain. The structure is similar to Optimistic Rollups, and the result is faster transactions and lower costs for each of them, since blocks are calculated in child chains, and not in the main network. Unfortunately, the project does not support all types of transactions, and the operation of complex dApps or DeFi projects is not possible. An example of Plasma solutions is OMG Network, plus they are supported by the Polygon network (which also employs many other scalability solutions).

Limitations of Layer 1 and Layer 2 Scaling Solutions

The joint work of L1 and L2 ecosystems also produces its own challenges:

- To transfer cryptocurrencies from the first level blockchains to the L2 networks, you need to use cross-chain bridges. This presents new security issues. The liquidity pool of these bridges is regularly hacked, with hundreds of millions of dollars going missing.

- To work with bridges, you must use a Web3 browser-based wallet, such as MetaMask or WalletConnect. In the wallet settings, you must first add the desired network — say, Optimism. Not everyone is comfortable with it, or understands how to do it. This creates more onboarding friction.

- L2 solutions, especially sidechains, split up liquidity, making each individual project weaker, and not stronger.

- Each dApp needs to ideally be integrated into each L2 network. This greatly complicates dApp development, makes it more expensive, and as a result slows down the development of the ecosystem as a whole.

If we exclusively used L1 networks, it would make life easier for both developers and users. But for now Layer 2 is a much needed crutch to make transactions on mainstream blockchains cheaper and more attractive.

What’s Next for Layer 1 and Layer 2?

One of the big questions for years to come is how useful Layer 2 solutions will be going forward as Layer 1 itself becomes more scalable. This is mainly due to the September release of Ethereum 2.0 with its 64 shards, which should provide up to 100 thousand TPS (instead of 15 in Ethereum 1.0). The finalization of the transaction, that is, its complete confirmation, should also take no more than 6 minutes. If all this turns out to be true in the long run, most of the Layer 2 projects may gradually become useless, and the bridges to them will lose their relevance.

In addition, some modern blockchains, including Polkadot and Kusama, are developed without the need to create Layer 2 in the usual sense. Instead, there is a main blockchain, a relay chain that provides security and communication, and many L1 blockchains around it — parachains. At the same time, parachains can transact with each other through XCM, without bridges. Due to this initially sharded structure, Polkadot can already carry out 1000 transactions per second without any issues. And no add-on is required here.

Layer 2 is currently several dozen successful projects with a capitalization of several billion. They have great resources and great teams behind them, and besides, these projects have long been accustomed to adapting to changing realities. And soon they will need to adapt once again. To prevent Layer 2 from dying completely over time, there are several options:

- L2 projects can develop to such a level that they become almost completely independent of their base chain, with a huge number of their own dApps and irreplaceable products. In this case, they can afford not to care too much about what updates happen to Ethereum or Bitcoin.

- Layer 1 blockchains can focus more on securing their systems and give Layer 2 networks the freedom to add various additional functions — as they can provide more speed and flexibility in decision making.

- Some experts working with L2 also expect the development of a new layer, Layer 3, working on top of the second. These can be protocols like Quant or ICON that provide interoperability with focus on transferring data. However, implementing the third layer would mean even more bridges, more points of vulnerability, and more system complexity. The practical use of the technology is starting to become too confusing as is, even for crypto adherents.

At the same time, if we think about the development of dApps on top of Layer 2 blockchains as L3, this seems more than realistic. Such projects create the need for L2 chains and, ultimately, for crypto as a whole. Our Polkapad launchpad is also working on development of new dApps, trying to provide even more growth for the ecosystem. We believe that more useful services, games and DeFi applications will eventually attract even more users to the world of crypto, and will allow existing projects to feel more secure.

If you want to participate in the launch of new successful projects or invest in IDO sales at the earliest stage, join Polkapad. We help good crypto developers to reach a wider community and get a head start in their dApp journey.

Read More:

How to Prepare for a Crowdsale. Startup Checklist: 25 Things You Need to Do Before Going Public

The State Of Launchpads. How To Safely Invest In Crypto Projects With Profit

Making Money on dApps: How to Build a Successful Decentralized Application

You may be interested

Learn basics in our free Wiki section!